Accrued Salaries Journal Entry Demystified

If they use non-reversing adjusting entries, employers still record accrued payroll at the end of the pay period. But instead of reversing the accrual, they true up or eliminate it once all payroll dues are paid. The accrued salaries are debited in the salaries account of the income statement and subsequently credited as Current Liabilities in the balance sheet of the company. Accrued Salaries are treated as a current liability because organizations need to settle this particular expense in the forthcoming future. This portrayal of accrued salaries as wage expenses provides a clear indication of the resources utilized to compensate the workforce, aligning with the principle of matching expenses with generated revenues.

How do you record adjusting payroll entries?

Reversing entries are an integral part of the accounting cycle, serving to negate the impact of prior accruals. When a new accounting period begins, the accrued salaries recorded as liabilities are due for payment. To ensure that the payment does not result in a duplication of expense recognition, the initial accrual entry must be reversed. This reversal is typically done on the first day of the new period, which is immediately after the date Bookstime the original accrual was recognized. The importance of mastering journal entries for accrued salaries cannot be overstated, as it ensures that financial statements provide a true and fair view of the company’s financial position. It also aids stakeholders in making informed decisions based on the company’s performance and fiscal health.

- By this definition, accrued expenses are expenses that are incurred by the company, but are not yet paid for.

- The use of the accrual method in recognizing these salaries aligns with the principle of matching expenses with revenues, contributing to a more comprehensive financial depiction.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

- They occur when the end of a pay period does not coincide with the end of an accounting period.

- In addition, the retailer incurred payroll taxes and fringe benefits amounting to $1,000.

- The effect of this journal entry would be to increase the utility company’s expenses on the income statement and to increase its accounts payable on the balance sheet.

Can you deduct accrued payroll on taxes?

Under the Generally Accepted Accounting Principles, corporations must use the accrual accounting method. The IRS also requires accrual accounting for certain businesses depending on their annual gross receipts. Small businesses not beholden to GAAP or IRS requirements can generally choose between accrual and cash-based accounting. For example, imagine you’re running a SaaS company where your team members have been working tirelessly throughout June, and it’s now the end of the month.

Related AccountingTools Courses

It also allows a company to record assets that don’t have a cash value such as goodwill. Account for any additions to the gross pay, such as commissions, bonuses, or other additional earnings. Then, tally up the deductions for each employee, which could include payroll taxes, health insurance premiums, and retirement plan contributions. Another issue is that it can be difficult to determine when what does accrued salaries mean a salary should be paid out, as this is dependent on when the employee has earned the salary.

While it may seem daunting at first, payroll accrual calculation is a systematic process that can be seamlessly integrated into your company’s financial practices once understood. It’s crucial for maintaining transparency and ensuring your company’s adherence to local and international labor laws. These are taxes that employers are obligated to pay on behalf of their employees, such as social security and Medicare taxes in the United States. Accrued payroll consists of all the expenses an employer may incur during a payroll cycle, such as employee compensation, payroll taxes, contributions to benefits plans, etc. Until the debt is satisfied, accruals are recorded as liabilities in payroll ledgers. Accrued payroll isn’t something that you should have to worry about calculating or even think about recording — in a perfect world, it’s accounted for automatically with 100% accuracy each pay period.

For the year ended 31st December 2021, they had total salaries amounting to $1,000,000. Under the normal business practice, Brings Inc. settles all salaries by the 10th of the following month. It is important to understand that the ideology behind this treatment is vested on the grounds of the matching principle, which requires expenses to be matched with revenues for the particular period.

Recording The Accrued Salaries In Company X’s Financial Statements

On the balance sheet, they appear as a current liability, reflecting the company’s obligation to pay its employees in the future. Thus, it is a feasible method of accounting for irregular work hours or leaves in a pay period. Consequently, it lengthens the accounting process since keeping track of the employees’ work hours is tedious.

What is the Accrued Salary? Definition, Example, and Journal Entries

This approach ensures accurate expense recognition and comprehensive financial reporting, reflecting the true financial position of an entity. By recording accrued salaries, a company can provide a more realistic depiction of its financial health, reflecting the true costs incurred to produce goods or services. This aligns with the principle of matching expenses with revenues, contributing to more accurate financial statements. This presentation is crucial as it accurately portrays the entity’s financial standing, allowing stakeholders to assess the magnitude of its pending wage payments. Essentially, accrued liabilities serve as a clear indication of the company’s commitment to fulfill its monetary responsibilities. Proper management of accrued wages is essential for maintaining financial transparency and ensuring that employees receive the remuneration owed to them.

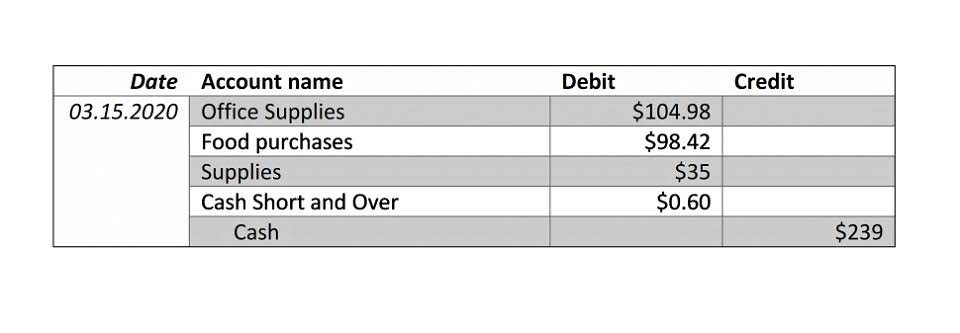

For example, recording the revenue from a customer job before the customer actually sends in the check is a form of accrual accounting. Accrual accounting also means recording financial transactions in the period that they occur regardless of when they are paid. In the case of salaries, this means recording employee wages after the hours are worked but before the payroll check is made. Salaries are typically fixed amounts that are easily calculated; hourly wages require a retained earnings bit more math to calculate. The accrued salary journal entry is used to record the salary expense and the related payable liability. The entry is typically recorded in the accounting period in which the work is done, even if the cash payment is not made.